Over the past few years, more and more people are looking to achieve financial independence and retire early. This has led to the popularization of the FIRE (Financial Independence, Retire Early) movement within the broader financial community. However, among the many different ways to achieve FIRE, one stands above the rest—Fat FIRE.

Fat FIRE is an early retirement strategy that allows you to live life on your own terms. It’s much more than just escaping the rat race and leaving the corporate world behind—it’s about achieving a level of financial independence that gives you the retirement you’ve always dreamed of.

But what exactly does Fat FIRE entail? What are its advantages and disadvantages? And what does it take to achieve?

This comprehensive guide will answer these questions (and more) by highlighting benefits and drawbacks of Fat FIRE and examining the financial resources and career steps needed to attain it. Whether you’re new to the FIRE movement or already on the path to early retirement, this post will help you determine if this approach is right for you.

With that being said, let’s dig a little deeper into the specifics of Fat FIRE.

What is Fat FIRE?

Fat FIRE is a financial strategy that allows you to retire early while also maintaining or even improving your lifestyle. The “Fat” part of Fat FIRE represents a more luxurious version of the FIRE movement, where you can live your idealized life in early retirement.

This doesn’t mean living on a portion of your pre-retirement income, but on your full pre-retirement income, if not more. It could mean living in a big city, going on luxurious vacations each year, or eating out as often as you want. It could also mean starting a foundation or using your resources to improve the lives of others. The point is that Fat FIRE gives you the ability to live the retirement that you want.

This is where this philosophy differs from its more frugal FIRE counterparts—Lean FIRE and Barista FIRE. Lean FIRE is when you use extreme frugality to retire early, but to a more modest lifestyle. For example, someone pursuing Lean FIRE could move to a lower cost of living area, get rid of their car, or reduce how often they travel in order to reach Lean FIRE earlier.

Barista FIRE, on the other hand, is a semi-early retirement, where you leave your traditional 9-5 job behind, but continue working part-time to help cover your expenses. For instance, someone on the Barista FIRE path might cover half of their expenses with investment income and the rest with a part-time job they enjoy—like being a barista.

As you can see, Lean FIRE and Barista FIRE both require some sacrifice on your part to retire early. You either have to reduce your spending (Lean FIRE) or continue working (Barista FIRE) in order to retire early. In contrast, Fat FIRE is about building a large enough nest egg that you don’t have to worry about either.

Because of this, achieving Fat FIRE is often a difficult financial goal. While the exact amount needed to achieve Fat FIRE varies, a retirement portfolio of approximately $3 million can be used as a minimum benchmark. However, depending on where you live and your lifestyle, your portfolio may need to be much larger.

Overall, Fat FIRE is an early retirement philosophy that allows for a more abundant lifestyle, but requires substantial financial resources and careful planning to achieve. Before we look at how to achieve Fat FIRE, let’s explore some of the key benefits that make it so attractive.

The Benefits of Fat FIRE

The benefits associated with reaching Fat FIRE are wide and varied. Below I have created a list of some of the keys ones to think about:

- Preservation of Lifestyle: One of the main reasons why some people are turned off by the FIRE movement (in general) is the level of frugality that you have to maintain in retirement. This is where the Fat FIRE movement stands out. Since it requires no sacrifice in your lifestyle, you get the benefits of early retirement without needing to continue working or cut your spending (as you would with other forms of early retirement).

- Freedom/Optionality: Along with preserving your lifestyle, Fat FIRE can also grant you more optionality to do what you want in retirement. If you want to try a new hobby, you can. If you want to work, you can. If you want to go on more vacations, you can. But, you don’t have to. The beauty of Fat FIRE is the freedom it offers you to choose what you do in retirement.

- Greater Peace of Mind: The substantial amount of assets needed to reach Fat FIRE can give you more peace of mind than you might have with other early retirement strategies. Of course, some people will feel like they don’t have enough even after they reach Fat FIRE, but that’s a problem that money will never solve.

- Less Reliance on Luck: The increased assets required for Fat FIRE means that your lifestyle in retirement will be less reliant on luck. You don’t need the market to return a certain percentage for you to retain your financial freedom. You don’t need to worry about being unable to work because of a health condition. You can remain retired even if you get a bit unlucky. While this won’t make you immune to every financial setback, it does decrease the likelihood that you’ll need to cut your spending or return to work.

- More Possibilities to Give: Lastly, if you retire early under Fat FIRE you have more capacity to give than someone who needs to keep their spending low or work an extra job to keep the lights on. While not a big benefit for everyone, for those that are passionate about philanthropy this is something to seriously consider.

Now that we have covered some of the benefits of Fat FIRE, let’s discuss the downsides associated with this philosophy and some potential challenges you may face in pursuit of it.

The Downsides of Fat FIRE

Though achieving a higher level of financial freedom and optionality through Fat FIRE sounds promising, it’s important to remember some of the downsides that could come along with it:

- Loss of Motivation or Purpose: Of all the reasons not to pursue an early retirement through Fat FIRE, the loss of motivation or purpose in your life is the most concerning. As I have discussed before, having enough money to do whatever you want isn’t always what it’s cracked up to be. Work is about much more than money. It influences your identity, your relationships, your health, and much more. Consider volunteering, finding new hobbies, or even doing some part-time work if it helps with this. Ultimately, if you decide to win the game, make sure you don’t win it too early.

- Extended Accumulation Phase: Since Fat FIRE requires more assets than other early retirement strategies, you will have to work longer as a result. This extended accumulation phase could mean that you end up retiring later than you originally planned. While Fat FIRE is an early retirement strategy, other strategies could potentially offer an even earlier retirement timeline.

- Less Flexibility/Increased Sacrifice Before Retirement: Given the high financial bar required of Fat FIRE, you will have less flexibility in how you live your life before you reach retirement. This additional sacrifice during your working years may be too restricted if you want to live a more enjoyable life in the years before you retire early. As much as I support the idea of early retirement, we have to balance this desire out against our enjoyment living in the present.

- More Reliance on Investments: Similar to the previous point, in order to reach Fat FIRE you will probably need to rely more on the returns of your portfolio than someone who requires a bit less to retire. Of course, most people will need growth in their investments to have an enjoyable retirement, but this is even more true for those that go down the Fat FIRE path. To do this, I recommend a diversified portfolio of income-producing assets. You can read more about my investment philosophy here.

- Mental and Emotional Difficulties: The pursuit of Fat FIRE can be both mentally and emotionally taxing. Not only does it require patience, discipline, and resilience in the face of setbacks, but it could also make you overly focused on money. The pressure to achieve your financial goals could make you neglect other important parts of your life. Sacrificing your relationships or health for an early retirement isn’t the tradeoff you think it is. Furthermore, straying from societal norms surrounding work and a more traditional retirement could impact your current relationships and how you relate to others.

Despite these challenges, if Fat FIRE still sounds appealing to you, then you’ll need to know how to achieve it. For this, we turn to our next section.

How to Achieve Fat FIRE

When it comes to achieving Fat FIRE, there are generally two approaches that you can take—earn a high income and invest your excess savings into a diversified portfolio of assets, or start a business with the hopes of having a successful sale. Because Fat FIRE is an early retirement strategy that requires a lot of assets, we don’t have enough time (and the compounding that comes with it) to build our asset base. As a result, we have to rely on high cashflows or a large liquidity event to reach Fat FIRE. I will detail both of these strategies below:

- Earn a high income and invest in a diversified portfolio of assets: Earning a high income is one of the most straightforward ways to achieve Fat FIRE, but it’s much easier said than done. A high income usually requires high levels of education, specialized skills, or a demanding job. Working in law, medicine, technology, or finance can provide such roles. If you decide to go down this route, you should:

- Acquire high-value skills and credentials: The first step is to build a high-value skill set or gain credentials that are in demand in the job market. This could be anything from a degree in a lucrative field to a specific set of technical skills that are sought after by employers. I know this works from experience after going through recruiting at a top school and using my data science skills to pursue other opportunities throughout my career.

- Maximize your earnings: Once you have these skills, it’s important to continually look for opportunities to increase your income. This could involve job hopping to obtain a higher salary, negotiating raises, or taking on additional responsibilities at work. Though all of these methods aren’t guaranteed to be successful, they should allow you to start figuring out what you need to do to raise your income even further.

- Live below your means: Even with a higher income, it’s important to live below your means so that you can save money. This doesn’t mean extreme frugality, but allowing your excess savings to be invested for long-term growth. While some lifestyle creep is okay on your journey, if you are trying to reach Fat FIRE, you will need to be more strict than most people.

- Invest aggressively: With a significant amount of income, you should be able to save and invest aggressively in a diversified portfolio of assets. This could include stocks, bonds, real estate, and other investment vehicles that produce streams of income. The more you can invest, and the earlier you do it, the quicker you can start compounding your wealth to reach Fat FIRE.

- Start a successful business and sell it: Starting a successful business and selling it represents a potentially faster, though riskier, way to achieve Fat FIRE. The goal here is to build a business that can be sold for a large enough sum for you to reach Fat FIRE. Here’s one way you could approach this:

- Find a problem to solve: The first step in starting a successful business is finding a problem to solve for a group of people. Look for areas where current solutions are inadequate or non-existent, and where you can leverage your skills and knowledge to provide a better solution. Generally you can choose to solve a small problem for a large group of people or a large problem for a small group of people. Depending on which route you go down will determine your overall business strategy.

- Develop a business plan: Once you’ve identified a promising problem to solve, create a comprehensive business plan. This plan should outline your business model, target market, marketing and sales strategy, financial projections, and more. It will serve as your roadmap as you start and grow your business. It’s okay if this business plan isn’t perfect to start. The important part is to come up with something, then get going.

- Secure funding: If your business isn’t profitable from day 1, then you’ll need some upfront capital. This could come from your personal savings, investors, or a business loan. Be mindful of the risks associated with each of these funding sources and its potential impact when you go to sell the business.

- Build and grow your business: Now, it’s time to execute and build your business. This step involves creating and refining your product/service, attracting customers, and scaling. Remember that running a business often requires long hours and hard work, especially in the early stages. This step will likely take years, but could even take decades before you can finally find a way to exit.

- Sell your business: Given that your ultimate goal is to sell your business, you need to come up with a possible exit strategy early on. This might involve identifying potential buyers or grooming the business for a possible IPO. I recommend reading The Messy Marketplace: Selling Your Business in a World of Imperfect Buyers by Brent Beshore if you want to learn more about this process.

- Though selling your business is one way to achieve Fat FIRE, another option is to not sell the business and instead live off the income it generates. While this has its own set of risks, it could allow you to achieve even more wealth in the future if your business is still growing when you plan to retire.

The two approaches above represent different ways in which you can achieve Fat FIRE in your financial future. Each path carries its pros and cons, but both exemplify that with discipline, hard work, and a little luck, a comfortable early retirement can be within reach.

Having examined the two primary methods to achieve Fat FIRE, let’s determine how much you might need to reach Fat FIRE.

How Much Do You Need for Fat FIRE?

Though the amount of money you will need to achieve Fat FIRE will vary based your lifestyle preferences in retirement, we can try to estimate it using a few different methods:

- Maximum Spending Rule: If you have the data, take the year where you spent the most amount of money during your working years and assume that you will spend this amount every year going forward. Then, multiple this amount by 25 (this is the 4% rule in reverse) and this gives you the total assets you would need for Fat FIRE. For example, if the most you spent in one year while working was $150,000, then you would need $3.75 million to hit Fat FIRE.

- Desired Spending Rule: Take the amount of money you want to spend in retirement and multiply by 25. Instead of using your maximum spending, you calculate how much you actually want to spend in retirement and back out the amount needed from there. If you want to be conservative, multiply this amount by 30 (instead of 25). This is the same as using a 3.33% safe withdrawal rate.

- Fat FIRE Suggested Minimum ($3M): As I stated earlier, $3 million seems like a good suggested minimum for achieving Fat FIRE because that would allow you to spend $120,000 per year. While some might say that this amount isn’t enough, consider the fact that I live in Manhattan (one of the most expensive places in the U.S.) and I don’t even spend $120,000 per year. Of course, I don’t have kids, but I do travel and eat out often and still spend under $10,000 per month, including rent.

- Join the 2%: Though estimating your expected spending in retirement is one way to figure how much you need to achieve Fat FIRE, you could also try to benchmark against other wealthy households. Unfortunately, after digging into the data, I discovered that you would have to be in the top 2% of U.S. households to reasonably achieve Fat FIRE, especially at a younger age.

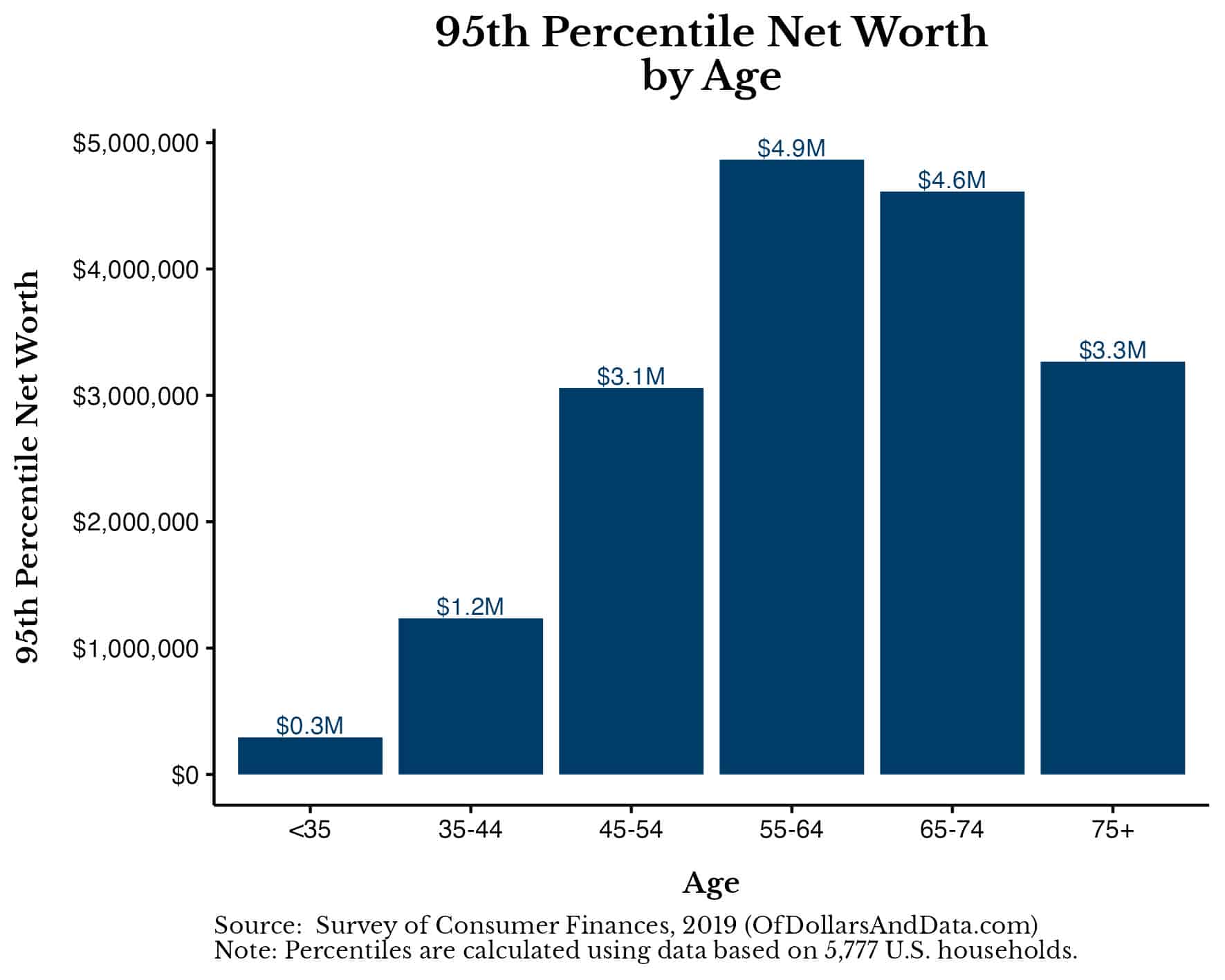

- You can see this clearly if you look at the U.S. households at the 95th percentile (top 5%) of net worth. Though the net worth needed to be in the top 5% of U.S. households is $2.6 million (across all age groups), it’s far lower for those in their mid-30s to mid-40s:

Given this information, you can see why it would be quite difficult for a younger household to achieve Fat FIRE even if they were in the top 5% of U.S. households.

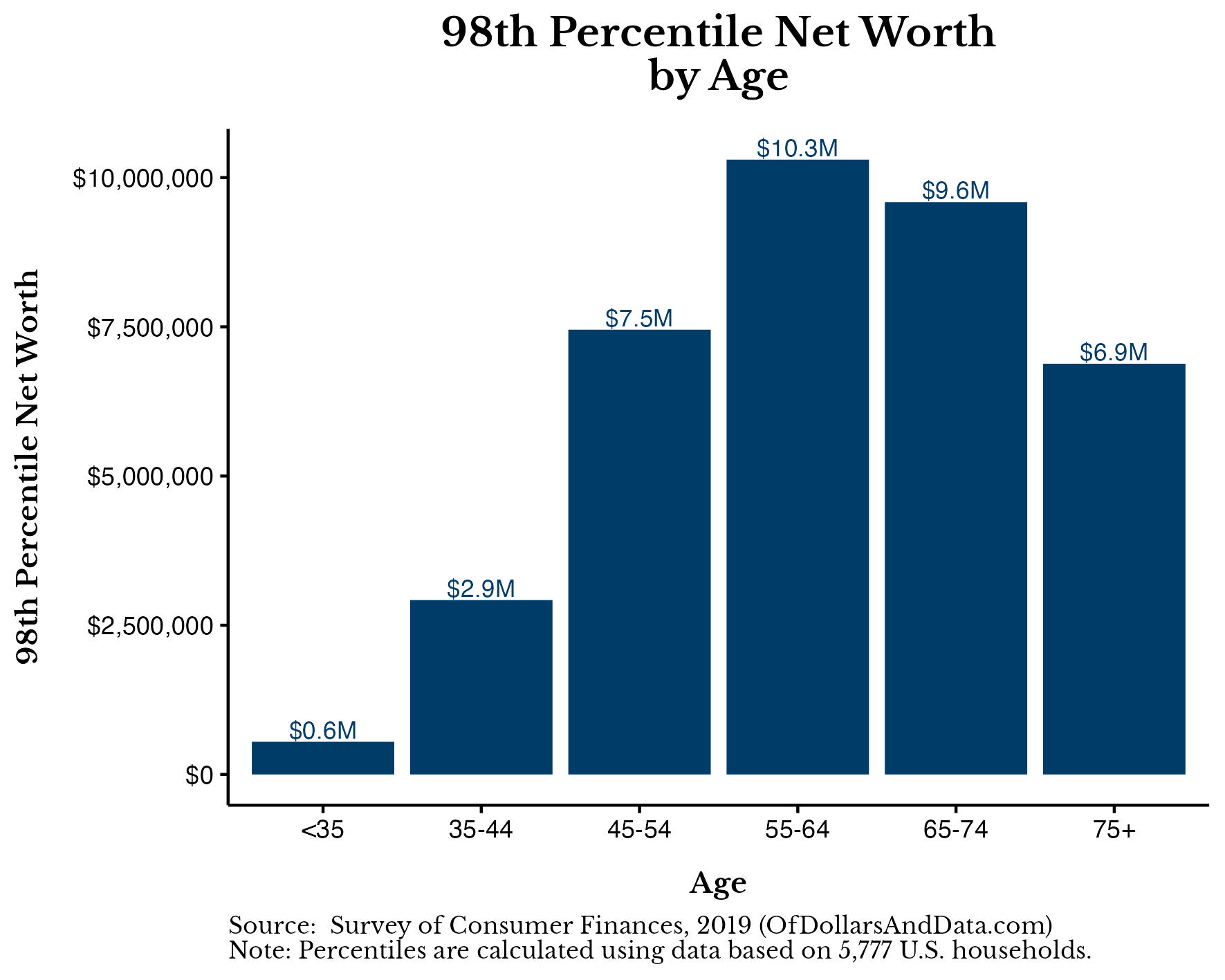

However, this changes when we look at the top 2%. It’s at this point that younger households begin to approach the amount needed for Fat FIRE:

If we were to use the top 2% of U.S. households as the entry point for Fat FIRE, then you would need $6.5 million (across all ages). While this number may seem high, it could be applicable for those who envision needing a bit more to live the life they desire.

Ultimately, no matter how you estimate your Fat FIRE needs, joining this elusive group will be the hardest part of your journey.

Now that we’ve reviewed how much you might need to achieve Fat FIRE, let’s conclude by discussing its implications for your financial future.

The Bottom Line

Fat FIRE represents a path to early retirement that allows you to live life without significant financial constraints. To achieve such an audacious goal, you first need to figure out how much money you will need in retirement. You can use the Maximum Spending Rule, the Desired Spending Rule, or some other benchmark as a way to estimate this.

Then, you will need to find a way to get there. For most people this means either: earning a high income while saving and investing diligently, or building a successful business and then selling it. While each of these path has its pros and cons, neither will be easy. Despite the large effort required, the reward for achieving Fat FIRE is a retirement lifestyle that many can only dream of. It is a lifestyle where you don’t have to worry about cutting back on spending or working part-time to cover your expenses. It’s about living the life you want and leaving the legacy you choose to leave.

But, before you embark on this journey, consider your personal desires, lifestyle preferences, and financial situation. Remember, that there’s no one-size-fits-all approach to retirement. What works for one person might not work for you, and vice versa. What’s more important is figuring out what you actually want out of life. As I like to say, “Before you decide what to retire from, make sure you know what you want to retire to.”

Happy investing and thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 355. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data