Do you want to own your own home, but find the idea of saving for it overwhelming? Well, you’re not alone. For most people, buying a home will be the biggest financial decision of their lives, so it makes sense to feel a little concerned about the process.

Nowhere is this more true than while saving for the down payment. With U.S. home prices up over 40% since January 2020, saving for a down payment is harder than it’s been in decades. In addition, now that the 30-Year fixed rate mortgage is above 7%, affordability is becoming a concern for many prospect homebuyers. According to Black Knight Inc., the mortgage payment to income ratio is the highest its been since the early 1980s.

But don’t let these figures dishearten you. This guide will walk you through how to save for a house in today’s current environment. In particular, I will detail the costs associated with buying a home, help you determine how much you need to save, and, finally, offer some tips to help you get there.

Knowing how to save for a house is a skill that will serve you throughout the rest of your life. So whether you are brand new to the home buying process or you need help to get your savings over the finish line, this post is for you.

Without further ado, let’s start by examining the costs of buying a home.

What Costs Should You Save For?

Before diving into how to save for a house, it’s crucial to understand what you are actually saving for. Purchasing a home is more than just covering the down payment. There are other initial costs to consider in addition to ongoing expenses that you should be prepared for. Let’s take a look at each of these in turn.

Initial Costs

In the process of buying a home, you will need to have money saved to cover the following initial costs:

- Downpayment: Typically the largest initial cost associated with buying a home, the downpayment is the amount of money that you pay upfront to the seller. Down payments can range from 3.5% (if you qualify for an FHA loan) to 20% (if you want to avoid having to pay for private mortgage insurance). Of course, you can put down more than 20%, but most buyers typically don’t.

- To be specific, if you want to purchase a home priced at $500,000, you would need to put down anywhere from $17,500 (3.5%) to $100,000 (20%) to buy it.

- Note that while you don’t have to put down 20% when buying a home, you should be able to. Why? Saving up 20% to buy a home (even if you don’t put down 20%) demonstrates that you have the discipline to save money. And it’s this financial discipline that will prevent you from defaulting on your mortgage if things get tough in your future.

- To be specific, if you want to purchase a home priced at $500,000, you would need to put down anywhere from $17,500 (3.5%) to $100,000 (20%) to buy it.

- Closing Costs: These are the fees you have to pay to finalize your mortgage. They typically range from 2% to 5% of the home’s sale price for the buyer. Therefore, on a $500,000 home, you might be expected to pay anywhere from $10,000 to $25,000 in closing costs. These costs may include:

- Loan Origination Fee: This is the fee charged by the lender to process your mortgage loan.

- Appraisal Fee: This is the fee for the appraisal, which is required to get a mortgage for a home.

- Title Insurance: This protects the lender and owner in case there are issues with the home’s title.

- Inspection Fees: Depending on the area and property, there may be several inspection fees required, such as pest inspection, home inspection, and so forth.

- Credit Report Fee: This is the fee charged by the lender to check your credit.

- Though this isn’t an exhaustive list of every cost you may encounter during closing, it should provide some context on what you might have to pay. But, remember, everything is a negotiation. If you think you have more leverage than the seller, you might be able to get them to cover some (or all) of your closing costs.

- Note: I didn’t include broker fees in the list above because it is standard practice for the seller to pay the broker fees (for the buyer and seller). However, seller’s typically incorporate these costs into the list price of the home.

- Lastly, while closing costs are to be expected in any home buying process, you can technically get a no closing cost mortgage where the closing costs are added to your loan and you pay a higher interest rate.

In full, when saving for a house, you should expect to set aside anywhere from 8.5% to 25% of a home’s sale price for initial costs. While you could pay even less than this upfront, you end up paying more later in terms of a higher mortgage rate or additional private mortgage insurance (PMI) upon closing.

Unfortunately, your initial costs won’t be the only thing that you need to save for when buying a home. Ongoing expenses are something that you will have to consider as well.

Ongoing Expenses

Once your initial costs have been covered, it would be prudent to set some money aside for the following ongoing expenses:

- Mortgage Payments: Your monthly mortgage payment will be your most significant ongoing expense. This payment typically includes repayment of your loan’s principal & interest, homeowner’s insurance, and property taxes. While most mortgage lenders roll taxes and homeowner’s insurance into your monthly mortgage payment (via an impound account), if they don’t, then you will need to pay these costs separately.

- Due to the nature of how mortgage payoff schedules are created, at the beginning of your mortgage you will mostly be paying interest (on the money you borrowed) and very little toward the principal balance of your loan. However, as you pay down the loan over time, this changes and you begin to pay down more principal and build more equity in your home.

- Maintenance and Repair Costs: When you own a home, you’ll have to do all its maintenance and repairs. These costs can be minor (e.g. fixing a broken door hinge) or major (e.g. replacing your roof or air conditioning unit). There are a few different ways to estimate how much you might pay on annual maintenance and repair costs including:

- The 1% rule: Assume you will pay 1% of the home’s value in maintenance and repair costs each year. So if your home is worth $500,000, set aside $5,000 for expected home repairs each year.

- The $1 per square foot rule: Assume you will pay $1 for every square foot of your home. If your home is 2,000 square feet, then you should set aside $2,000 a year to cover these costs.

- Use the average: According to this New York Times article, “Nationally, the average annual maintenance cost of single-family homes during the first quarter of 2023 was $6,409, up about 9 percent year over year.” While the average annual maintenance cost won’t tell you much about your particular living situation, it can be a decent guide for estimating how much you might spend on repairs as a homeowner. For example, you could take the average annual spend and adjust it up or down depending on the age of your home and where you live.

- If you really want to get into the weeds on home maintenance, this article has some good cost estimates for different kinds of common home repairs.

- Regardless of which method you use, setting money aside for maintenance and repairs is essential as a homeowner. Whether you decide to save for this on a monthly basis or create a special home emergency fund is up to you. The point is to save something and expect these costs in your future.

- Utilities: Once you become a homeowner, you’ll be responsible for the monthly utility costs that renters don’t always have to worry about. These include: gas, electric, water, trash & recycling, internet, and possibly more. While utilities aren’t always a significant cost as a homeowner, if you live in an area with extreme weather conditions, your electric or gas bill could be larger than you initially imagine.

- Homeowner Association (HOA) fees: If you’re considering purchasing a property in a neighborhood association, such as a gated community, townhouse, or condominium complex, you might be required to pay Homeowner Association (HOA) fees. These fees are typically used to cover the costs of maintaining and improving shared spaces, like the landscaping, swimming pools, gyms, security gates, and building exteriors.

- HOA fees vary significantly depending on where you live and the amenities that your community offers. For example, while the average HOA fees in the U.S. are only $170 a month, in New York City HOA fees are closer to $1,600 a month. More importantly, HOA fees can increase over time as the community’s maintenance and improvement needs grow. Keep these costs in mind if you want to own a home in a particular planned development.

Now that we have looked at all the costs associated with buying and owning a home, let’s determine how much you need to save to get there.

How Much Do You Need to Save?

When it comes to saving for a house, the big question is: how much? Unfortunately, the answer isn’t always straight forward. For example, if we assume that you wanted to save 20% for a down payment and 5% for closing costs for a home valued at $500,000, then saving $125,000, or 25% of the home’s value, might be enough.

However, numerous other factors could prevent you from achieving that goal. For example, what if home prices soar while you’re saving up? Or what if you get into a bidding war with another buyer? Also, did you have room in your budget for new furniture, moving expenses, and repair/maintenance costs in the first year?

Pretty quickly you can see why planning to save 25% of a home’s value may not be enough if you want to start your homeownership journey with ease. So how much should you save then?

One strategy is to use a savings buffer. For example, if you estimate that it will take you two years to save 25% of your desired home’s value, consider adding an extra 10% to this amount. This 10% is a buffer that accounts for potential inflation (~4% annually), initial maintenance/repairs (1%), and other unforeseen expenses (1%) during the home buying process. To make sense of this, we can approximate this savings buffer with a formula:

% of Home Value Needed = Down payment + Closing Costs + Expected Inflation + Maintenance in Year 1 + Misc.

Filling in with the rules of thumb from above:

% of Home Value Needed = 20% + 5% + 4%*(Years Needed to Save 25% of Home’s Value) + 1% + 1%

Therefore, if it would take you a year to amass 25% of your dream home’s value, then you’d actually need to have 31% of its value saved. If it would take you two years to get there, you’d need 35% of its value saved, and so forth.

While this might seem like a lot, remember that this is a conservative approach to saving for a home. As a result, you will take longer to reach your savings goal if you follow it. However, the upside is that you’ll be in a much better position financially when you get there. After all, it’s better to oversave and have a savings buffer than to undersave and be strapped for cash as a new homeowner.

Lastly, please keep in mind that these estimates may not apply to your local housing market. For example, I assume that U.S. home prices will increase by ~4% per year (as they did for the last 20 years), however this is much faster than most of U.S. real estate history and may not be reflective of what you will experience in the future.

Now that we’ve looked at how much you need to save for a home, let’s dig into some simple tips that can make the process easier.

Simple Tips to Save For A House

When it comes to saving money to buy a home there are two things we will cover—how to save more money (to reach your goal faster) and where to put that money while you wait.

How to Save More Money

When it comes to saving money, there are basically two levers that you can pull—increase your income or decrease your spending. After all, how much you save in a given time period is just your income minus your expenses during that time period. For example, on a monthly basis your savings would be:

Monthly Savings = Monthly Income – Monthly Expenses

To save for a home (or anything for that matter), you have to get this equation to be as positive as possible until you reach your goal.

In the short run, this usually means reducing your expenses. You could do this by going out to eat less often, reducing how often you travel, or cancelling some of your subscription services, among other things. Anything that reduces how much you spend on a monthly basis will help you save money…for now.

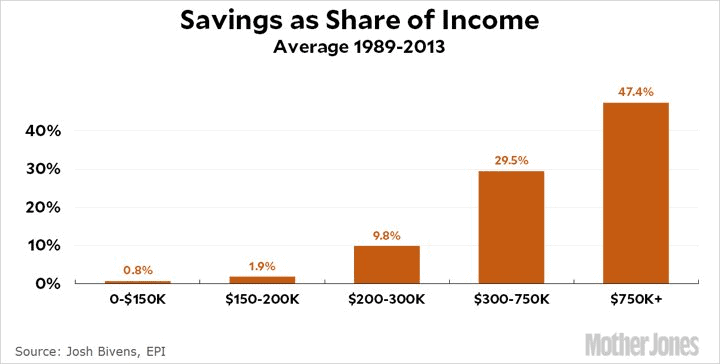

However, cutting spending has its limits. At some point you won’t be able to cut anymore and your monthly savings will stagnate. This is why the only sustainable path to increase your future savings is to raise your income. I demonstrated this last week when illustrating how savings rates tend to rise with income:

As you can see, those with higher incomes are able to save a larger percentage of their paycheck. The same is probably true for you as well.

To help in this regard, I’ve listed a few different ways to raise your future income:

- Freelancing and Side Gigs: Depending on your skill set, consider freelancing in areas such as photography, design, tutoring, or consulting. Websites like Upwork, Freelancer, and Fiverr offer platforms for individuals to offer their services to others. Alternatively, you could drive for ride-sharing services, rent out a spare room, or sell products and art online to make more money.

- Pursue Promotions or Raises: For those that have a job, pursuing a raise or promotion can provide for a boost in income.

- To do this, set a meeting with your supervisor to discuss potential career advancement or raise opportunities. If it’s been a while since you’ve had a raise, ask for a raise by highlighting your accomplishments and demonstrating the value you’ve added to the company.

- If you encounter any resistance, mutually agree upon a set of goals or metrics that, once achieved, will clearly demonstrate your eligibility for a raise or promotion.

- One helpful tip is to try and be on the revenue generating side of whatever business you are in. If you can show the dollars and cents that you’ve brought to the company, it will be much easier to justify a pay increase than if you are merely viewed as a cost.

- Consider a Job Change/New Opportunities: Sometimes switching to a different company or industry can result in a significant pay bump. Regularly browse job listings to stay informed about how much your industry is paying for your role and for any new opportunities that may arise.

- If you aren’t finding opportunities that entice you, then you might want to spend some time creating them for yourself. How so? Learn new skills and network. Spending time to learn a valuable, marketable skill can be the way that you transform your career and raise your long-term income. Though this path isn’t easy, it can be very rewarding if you stick with it.

- Entrepreneurship: If you have a business idea or are passionate about something, consider starting a business to capitalize on it. Whether you want to start a small online store, a consultancy firm, or a local cafe, owning a business can be an additional source of income. However, keep in mind that there are considerable risks associated with this strategy. This is especially true if you have to use your own money to start the business.

Though this list isn’t comprehensive, it should provide you with some high-level ideas that you can put into practice today to start growing your income.

Of course, investing in diverse set of income-producing assets is another way to increase your income. However, as I discussed last week, it can take a while before this income stream is significant enough to make a dent in your financial life.

Now that we have an idea on how to save more money (by increasing your income), let’s explore what to do with the money once you’ve saved it.

What To Do With the Money You’ve Saved

When it comes to saving for a large purchase such as a home, the right way to go about it is to focus on safety. For most people that means holding cash in some form or another. While you can put your savings into stocks or bonds as you save up, as I’ve demonstrated previously, there is strategy can be quite risky.

And when it comes to saving for a big purchase, the last thing you want to deal with is market risk or interest rate risk. Nevertheless, you don’t necessarily have to place your savings into a checking account (which may be earning near zero interest). Instead, you should consider parking your cash in one of the following options:

- High-Yield Savings Accounts: These are FDIC-insured (up to $250,000) accounts that offer higher interest rates than standard savings and checking accounts while being basically just as liquid. High-yield savings accounts allow up to six withdrawals per month without incurring any fees. Unfortunately, the yield offered on these accounts isn’t fixed and will change over time as market conditions change.

- Money Market Accounts: Similar to high-yield savings accounts, money market accounts are FDIC-insured accounts that pay a yield on your cash holdings. Money market accounts tend to pay more than high-yield savings accounts, however there are more restrictions on withdrawals and the minimum balance needed to utilize the account.

- Note that money market accounts are different from money market funds which are not FDIC insured.

- Short-term certificates of deposit (CDs) are another saving option, but you won’t have access to your capital (without a penalty) for a predetermined amount of time. Because of this I generally prefer other options on this list.

- U.S. Treasury Bills: If you want to go straight to the source, you can invest your accumulated savings directly into U.S. Treasury bills. While these typically provide the highest yield of the options listed here, you also face more risk (via interest rate changes). Though you will get your principal back regardless of what happens with interest rates, if you need to sell your Treasury bills before they mature, you could incur a loss.

- For example, those that had their money invested in Treasury bills at the beginning of 2022 saw their value plummet as interest rates increased quickly throughout the year. While short-term Treasury bills are less sensitive to interest rates than longer duration bonds, keep in mind that their values will decrease if rates rise.

- Lastly, while the U.S. government has always paid its debt obligations, there have been moments of political tension where the possibility of default on Treasury bills was a reality. Although such events are rare, it’s still important to be aware of this potential risk.

In summary, while the journey to homeownership requires diligent saving, it’s equally important to safeguard those assets along the way. By considering the options listed above, you can ensure your hard earned money grows safely as you get closer to buying your dream home.

Now that we’ve covered some simple ways to save for a home and where to safely store those savings, let’s wrap things up by explaining why it matters.

The Bottom Line

Buying a home, particularly in today’s market with rising home prices and increasing mortgage rates, is undoubtedly challenging. However, with the right knowledge and strategies in place, you can navigate this financial journey with confidence.

So don’t forget the costs associated with homeownership, the amount you might need to save, and the saving strategies that can help you get there. Of course, there is no one-size-fits-all solution when it comes to how to save for a house, but I hope that the ideas discussed today help you determine your ideal path forward.

The road to homeownership is paved with challenges, but it also filled with lessons and, hopefully, a place that you can eventually call…home. Happy saving and thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 359. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data