You probably first learned about the theory of evolution the same way I did. Do you remember the story? Darwin is in the Galápagos Islands when he notices something peculiar about the various finches living there. Each finch species had a different kind of beak. On some of the islands the beaks were small, while on others they were large. Some were pointy and some were smooth.

As Darwin continued to observe the finches, he realized that their beaks were well suited for acquiring food on their particular island of residence. It was as if the finches had adapted their beaks to fit their environment. As Darwin wrote in The Voyage of the Beagle:

Seeing this gradation and diversity of structure in one small, intimately related group of birds, one might really fancy that from an original paucity of birds in this archipelago, one species had been taken and modified for different ends.

Evolution by natural selection was born.

This isn’t exactly how Darwin discovered evolution and it doesn’t describe how evolution actually works, but it does address the evolutionary topic with the most attention—the environment. Anytime we discuss evolution we tend to focus on the environment in which the species evolved. Fur works for the cold, sweat works for the heat, so on and so forth.

However, by focusing solely on mother nature we miss half the story. Because evolution isn’t just about adapting to the environment. It’s also about adapting to the other players in that environment. We don’t just evolve to face the elements, we also evolve to face each other.

This is the critical point made by Matt Ridley in The Red Queen: Sex and the Evolution of Human Nature. In the book, Ridley argues that there is an evolutionary arms race between predators and prey, parasites and hosts, and even males and females. This ongoing conflict implies, as Ridley suggests, that “the struggle for existence never gets easier.” As Ridley states in his book:

One of the peculiar features of history is that time always erodes advantage. Every invention sooner or later leads to a counterinvention. Every success contains the seeds of its overthrow. Every hegemony comes to an end. Evolutionary history is no different…The faster you run, the more the world moves with you and the less progress you make. Life is a chess tournament in which if you win a game, you start the next game with the handicap of a missing pawn.

Named after the Red Queen from Lewis Carroll’s Through the Looking-Glass, the theory implies that you cannot stop adapting. You have to run as fast as you can just to stay in the same place.

Just like the evolutionary arms race that Ridley describes, there is an investors arms race going on as well. Once an investor finds an edge, it is only a matter of time until others figure out that edge and start copying it. Long-Term Capital Management (LTCM) learned this lesson the hard way as explained by Sebastian Mallaby in More Money Than God:

Even though Long-Term shrouded itself in secrecy, routing its trades through multiple brokers so that none of them could understand its bets, an army of imitators had pierced together much of its strategy. The upshot was that LTCM’s large portfolio was mirrored by an even larger superportfolio created by its disciples, meaning that LTCM’s trades were monstrously crowded.

These mirrored trades were partially what led to LTCM’s demise when it couldn’t exit its positions without causing markets to tumble. What had worked for LTCM for years suddenly stop working.

Sheelah Kolhatkar described a similar arms race among hedge fund managers who used expert networks to try and gain better information on public companies in her book Black Edge:

The use of these expert networks was widespread in the hedge fund industry—once a few funds started using them, everyone else had to do so as well to try and keep up with their competitors.

But, even this wasn’t enough for some funds who eventually turned to inside information (i.e. black edge) to gain an advantage. Kolhatkar again:

When the incentives were so huge and you had so many funds competing to the death—all of them with the same Wharton-trained wizards on staff, the same state-of-the-art technology systems, the same expert network consultants, the same greed and determination—how else could you rise above everyone else and beat the market year after year?

Move. Countermove. And the Red Queen rushes ahead.

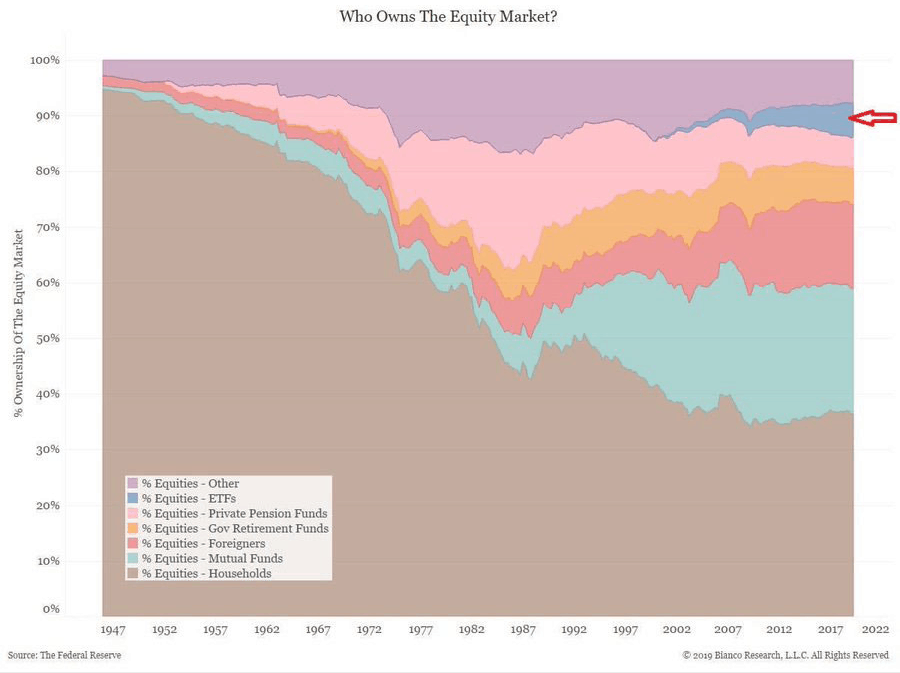

But this isn’t just a reality for hedge funds and traders, individual retail investors have to deal with the Red Queen as well. Consider how much investing has changed over the last century. In the 1950s your competition was mostly fellow households, but now you have funds, foreigners, and institutions to contend with too. As Nate Geraci illustrated in this chart, who owns the equity market has changed:

What impact will this have on retail investors? Does it present new risks? If so, what kinds? I don’t know the answer to these questions, but I do know that any complex, adaptive system like the stock market will continue to evolve based on the decisions made by its many participants.

This is why investing will never be easy. Because if it was, then other investors would arbitrage any such easy return streams until it wasn’t easy anymore. This explains why “buy the dip” will continue to work in this relentless bull market…until it doesn’t. Or why gaining more information is advantageous until everyone else has that information as well. Back and forth. Back and forth. Yet the Red Queen never tires.

You Have to Earn It

With the advent of low cost indexing and diversification, investing has never been easier, right? Possibly, but maybe not. It seems quite plausible that retail investors are taking less risk now than they used to so they should expect lower returns. You may not agree completely with the logic, but would you be surprised by it if it were true? To echo what my colleague Michael Batnick recently asked, “Why should you get reward with no risk?”

If the Red Queen has taught you anything, it should be that you (and your assets) will never be safe. No advantage will persist forever. While biological terrors will come for your life, financial terrors will come for your portfolio. Chaos, inflation, and doubt will haunt your investments. And should it be any other way? I think not.

Because you have to earn your keep. You have to be disciplined. You have to work hard and keep working hard to hold onto your lead. Because if it was handed to you, it will be taken back in time. The Red Queen guarantees it. So never stop running and make sure you earn it.

If you enjoyed the ideas in this post, then I know you will love the work of Matt Ridley. Check out The Rational Optimist as well as The Red Queen to understand why. Thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 138. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data