I have a confession to make. Over the last eight months I’ve been writing articles in the hopes of ranking well on Google for specific search terms. This practice, known as search engine optimization (SEO), aims to make content more discoverable by search engines.

For example, when you search the term “medallion fund” you should see my article somewhere near the top of the results. The same is true if you search the term “fat fire” or a handful of other financial terms.

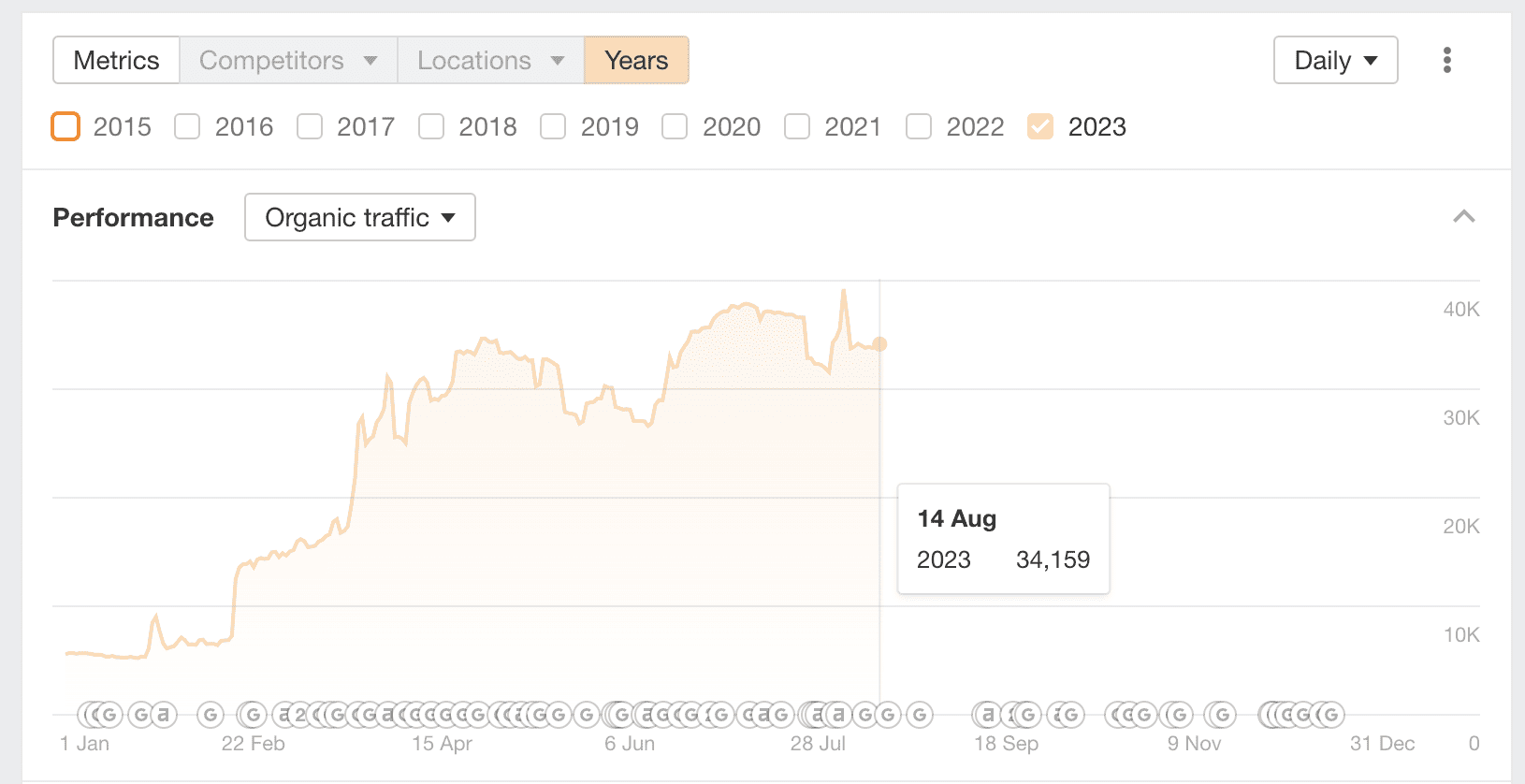

And guess what? It’s been working. Since the beginning of 2023, my website traffic from Google has increased by 6x:

As a result, I’m now getting twice as many monthly visitors from Google compared to Twitter. This is true despite the fact that I have nearly 150,000 Twitter followers.

On one hand, this is great. My blog is getting more passive traffic from people searching for financial terms and discovering my site organically. I don’t have to fight for these pageviews (like I do on social media), they just come to me.

But, on the other hand, this strategy is slowly destroying my will to write. Writing for search engines is soul-killing work. Why? The reason is simple—I’m not writing about what I want to write about, but what other people want to read about. I’m writing to get more pageviews (i.e. money) and not because I’m particularly interested in how to save for a house or how much you need in your emergency fund.

And, while I’ve been putting in the time and effort to thoroughly research these topics and provide as much value as possible to my readers, my heart and soul haven’t always been in them. You can tell pretty easily when comparing my SEO posts to the posts where I’m passionate about the underlying idea (see here or here).

If you’ve enjoyed my articles on “wall street movies” or “rich vs wealthy” or “generational wealth“, that’s great. I appreciate you reading along.

But, I’ve decided to make a change. I can’t keep doing this and preserve my creative sanity.

One of the reasons I’ve been able to blog consistently for nearly seven years is because I’ve always chosen what I write about. I’ve been able to follow my curiosity wherever it has led me.

Unfortunately, this year I strayed a bit from that path. And while I don’t consider it a major mistake, I’m glad I realized what was going on before it was too late.

It’s funny because I’ve written on this topic before when I argued that you should reject the algorithm (in regards to Twitter). Yet, only a few months later I was writing for a different algorithm altogether—Google.

And while you can write for an algorithm for a while, it eventually degrades your creative energy. I’ve experienced this first hand and have seen it happen to others as well. Of the few financial bloggers I knew that focused exclusively on SEO content, all of them eventually gave up.

I didn’t think anything of it at the time, but now I know why they stopped blogging. They got tired of writing about “jobs for 14 year olds” and “how to make 1000 dollars fast” to get more traffic. They weren’t truly interested in what they were writing about, so they quit.

The same thing was slowly happening to me. I was creating listicles about these random personal finance topics and dreading it the whole time.

But, then I decided to create an S&P 500 historical return calculator and found myself totally consumed by it. I spent all day Sunday building it and loved every moment of it. My problem wasn’t my motivation, it was what I was working on.

So last weekend, I decided to one up myself and create an S&P 500 DCA calculator to determine the total growth on a set of monthly investments into the S&P 500. Let me tell you, when I finally got that dynamic chart working, it felt incredible. I might as well have won the Super Bowl.

That’s when the realization hit me—only the passionate survive.

Because if you aren’t passionate about what you’re doing, you’ll give up. You’ll burn out. You’ll throw in the towel. This is true whether you’re creating content, starting a business, or trying to have a successful career.

I know this sounds cliche, but it’s 100% true. And, as much as I’ve tried to ignore it, this idea keeps finding it’s way back into my life.

This is why you have to find something that you can keep doing week in and week out. Steve Jobs said it best in his 2005 Stanford commencement speech:

You’ve got to find what you love. And that is as true for your work as it is for your lovers. Your work is going to fill a large part of your life, and the only way to be truly satisfied is to do what you believe is great work. And the only way to do great work is to love what you do.

If you haven’t found it yet, keep looking. And don’t settle. As with all matters of the heart, you’ll know when you find it. And, like any great relationship, it just gets better and better as the years roll on. So keep looking. Don’t settle.

Let this be your wakeup call. Let this be a moment for you to re-evaluate your priorities and, possibly, switch gears. Because life is too short to work on things that don’t make you come alive.

After all, in the end, only the passionate survive. Thank you for reading.

If you liked this post, consider signing up for my newsletter.

This is post 361. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data